However, the growth of nonperforming loans, especially in the Southern nations (Spain's going to be in trouble with the Catalonia referendum), will create this next banking crisis. There is already over $600 USD worth of nonperforming loans. 18% of Italian banks are in trouble already. With over 500 banks, Italy's banking sector is split an not unified. Especially since it has the third-largest economy in the Eurozone, people must take action.

Italy has taken steps by creating the Atlanta, a backup to bail out banks. It has also allowed these nonperforming loans to be merged into government-backed bonds to make them more appealing. This plan barely falls within EU rules regarding bailouts, and it may be challenged. A big change is the legislation to make the foreclosing process for properties more efficient. Right, now, it can take up to 15 years just to claim a property back. People don't have that kind of time.

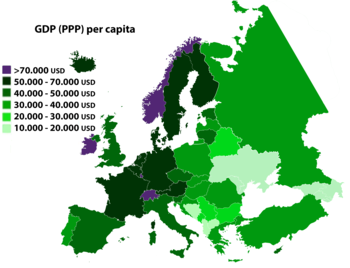

Despite Italy's problems, there is a deeper one that affects the southern EU nations: lack of competitiveness. These economies have no reason to compete with each other, and so they are just drifting along. While the northern nations continue to grow with industry and technological development, and desire to compete on an international level, southern nations are not. Because of all of the inflation within the EU as a whole, these economies are becoming less competitive. Having a bailout like Greece would be devastating, so another method would be to reduce government spending and wages. Who would want that though?

Despite Italy's problems, there is a deeper one that affects the southern EU nations: lack of competitiveness. These economies have no reason to compete with each other, and so they are just drifting along. While the northern nations continue to grow with industry and technological development, and desire to compete on an international level, southern nations are not. Because of all of the inflation within the EU as a whole, these economies are becoming less competitive. Having a bailout like Greece would be devastating, so another method would be to reduce government spending and wages. Who would want that though?

Leaving the Euro would not help, as the debts would still exist, just in a different value. If people could pay Euro debts with a new currency at a new set rate, the loss would spread to debt holders. It seems that transfer payments from the northern countries will not increase as they do not want to continue funding these subsidies. Having two currencies may pose as a solution, where a "soft" Euro would work in the south and a "hard" Euro up north. the soft Eyro may trade at a reduced rate with the other Euro and alleviate the situation a bit. But issuing completely new currencies would absolutely be detrimental.

As Europe's north and south grow distant of each other, using the Euro as the common currency does not seem financially viable. Maybe there will be more 'Brexits' and bailouts?

https://www.huffingtonpost.com/joseph-v-micallef/europes-next-financial-cr_b_10315364.html

https://www.cnbc.com/europe-news/

Comments

Post a Comment